Unlock Hidden

Market Opportunities

Buy and sell unlisted shares with ease.

Access exclusive pre-IPO investments Before it gets Listed.

Research Driven

Detailed reports, expert analysis, and insights enabling decision making.

Safe & Transparent

Bank-grade security, transparent pricing.

Quick Process -Invest In 3 Clicks

Invest seamlessly in just three clicks.

High Potential Opportunity

Access unique growth stories before they go mainstream.

Opening doors to growth stories unavailable in traditional markets.

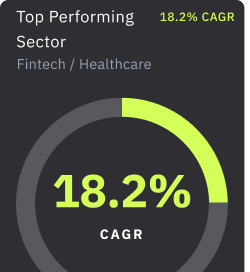

Our platform is designed to make high potential opportunities accessible to everyone. With research-driven insights by SEBI registered Analysts, you stay informed. A safe and transparent process with bank-grade security ensures your investments remain protected. At the same time, our quick 3-click system makes the journey seamless and hassle-free. Most importantly, we bring you access to high-potential opportunities,

Handpicked opportunities for smart investors.

₹345

₹9600

₹1350

₹460

₹29

₹2,650

₹122

₹1915

Ready to Trade Smarter?

High Demand Zone

Pre-IPO of NSE oversubscribed!

New Listing Alert

Company Groww and Lenskar enters secondary market!

This week's top performer

Company OYO up by 18%!

Limited Shares

available for Company SBI MF Pre-IPO demand rising!

We have best team and Seamless process

Get In Touch

Share the company name and number of shares you wish to buy. Our experts will get in touch and finalize the deal terms with you.

Deal Processing

This includes standard KYC requirements such as your PAN Card, Aadhar, and a Demat account CMR copy to handle the documentation and prepare your transaction securely.

Shares Transfer

The Pre-IPO shares are transferred directly to your Demat account. You can expect the transfer to be completed within 1-5 business days, making you a shareholder in a high-potential growth story.

Want to get your Company Shares listed, please fill the form by clicking above link – Our Team will get in touch with you.

What our clients

has to say

Glad to have invested in SBI Mutual Fund at the pre-IPO stage. Your early access, clear guidance, and support made the decision easy. Excited for future growth.

Seema Jaiswal

Investing in NSE pre-listing was a smart move. Grateful for your early insight, seamless execution, and confidence-building support throughout the process.

Ajay Singh

Thank you for facilitating the early-stage investment in Garuda Aerospace at a ₹100M valuation. Truly appreciate your valuable guidance, early insights.

Supriya Sajja

Zypp Electric offers a strong investment opportunity in the EV sector. Grateful for access to early-stage ventures and a smooth, well-guided investment process.

Devrat Dhiman

Got Questions?

Let Us Help

1.What are unlisted shares?

Unlisted shares are company shares that are not traded on stock exchanges like NSE or BSE. They are usually owned by founders, early investors, employees, or private funds. These shares are bought and sold through private deals, brokers, or regulated platforms.

2.Why are pre-IPO shares popular?

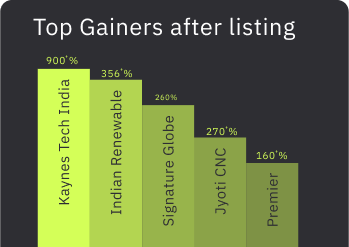

Pre-IPO shares are shares bought before a company gets listed on the stock exchange. They allow investors to enter early, often at lower valuations than the IPO price. If the IPO performs well, early investors may see strong returns once the stock starts trading. They also offer exposure to high-growth startups and exclusive opportunities not open to regular retail investors.

3.What are the benefits of investing in unlisted shares?

Unlisted shares give investors the chance to invest in young or fast-growing companies before they enter the stock market, often with higher upside potential. They can deliver better returns than listed stocks if the company scales, gets acquired, or goes public successfully. Such investments also help diversify a portfolio beyond public market cycles, and in some cases, investors may benefit from favorable valuations, special allocations, or strategic stakes in promising businesses.

4.What happens if a company never goes for IPO?

If a company never lists, your shares stay privately held and there is no guaranteed public market to sell them. In such cases, liquidity depends on secondary buyers, private deals, company buybacks, or mergers and acquisitions. Some firms allow limited exits through buyback programs or employee share sales, but these are not assured. Ultimately, your returns depend on the company’s performance and the exit options available.

5.Where can we view the unlisted shares we baught?

Unlisted shares are held in demat form through NSDL or CDSL, similar to listed shares.

You can view your holdings using the ISIN number associated with the company.

If you face any difficulty, you can contact your respective demat account’s customer care, and they will assist you with the details.

6. What is the lock-in periods for unlisted shares after buying?

The lock-in period for unlisted shares is usually 6 months after the company gets listed on the stock exchange.

Before listing, you can sell them anytime through off-market transfer, as there’s no fixed lock-in period while they remain unlisted.

7.Can I invest in unlisted shares if I am not a regular investor?

Yes—you can invest even if you are not a regular investor, but it’s important to understand the basics and risks first. Use regulated brokers or platforms that handle KYC, escrow, and legal documentation. Start with a small amount, treat it as high-risk capital, and avoid putting too much of your savings into it. If unsure, consider professional advice or co-investing with experienced investors. Keep in mind that unlisted shares may not provide quick liquidity or low volatility.

8.What is the minimum amount required to invest in unlisted shares?

The minimum investment in unlisted shares varies by company, seller, and platform—there’s no fixed amount. Some online or fractional platforms let you invest small amounts, while direct private deals usually need larger sums. Transaction costs like broker fees, stamp duty, and approvals can increase the required cash. Always check the lot size, platform minimums, and all costs before investing. Even small investments carry the same risks and limited liquidity as larger ones.

9. What kind of return can one expect from investing in unlisted shares?

Returns from unlisted shares can vary greatly and are not guaranteed. Successful pre-IPO or growth-stage investments may deliver multiples of the invested capital over several years, but many deals provide modest returns or may fail. Illiquidity means it could take years to realize gains, and interim valuations are often uncertain or based on private negotiations. Diversifying across multiple deals helps reduce the impact of any single failure. Be cautious of promises of overly high returns.

10. Who sells unlisted shares of private companies?

Typical sellers of unlisted shares include founders, early investors, employees (through ESOPs), angel investors, and venture capital or private equity funds looking to exit or rebalance. Companies may also run buybacks or liquidity programs for stakeholders. Shares are sold via secondary brokers, private negotiations, or regulated secondary platforms. Large shareholders may sell during follow-on funding rounds or strategic exits. Always verify the seller, chain of ownership, and any board approvals required, and use escrow, proper documentation, and verified platforms to reduce fraud risk.

11. How safe are unlisted shares to buy?

Unlisted shares are usually riskier than listed stocks due to lower regulatory oversight, limited public information, and low market liquidity. Their safety depends on the company’s business model, governance, financial health, and proper legal documentation. Conducting thorough due diligence, independent verification, and using regulated brokers or platforms with escrow and verified processes can reduce risk. Be cautious of red flags like unclear ownership, legal issues, or unrealistic growth claims, and never invest money you can’t afford to lock in for a set period.

Our blogs

Find what's next

1. Market Leadership & Scale SBI Mutual Fund commands a 15.55% market...